Smoking out the cause of the debt crisis?

Recently economists at ConvergEx, the New York-based trading software company, claimed that counting the cigarette butts in a nation’s ashtrays gave a good estimate of national indebtedness.

They found a correlation between smoking rates and debt-to-GDP ratio: the higher the smoking rate, the deeper the debt. “The relationship is strong enough that counting the cigarette butts in the ashtrays of street-side cares around the world could safely be called sovereign debt research” according to Nicholas Colas, chief market strategist at ConvergEx.

Was he joking? I hope so because a market strategist who confuses correlation with causation is not one calculated to inspire confidence. Press reports from New Zealand, picked up by the Stats Chat website, say that the cigarette end method works especially well in Europe, where heavy-smoking Greece is in debt up to its hocks, while lightly-indebted Finland has a smoking rate of only 18 per cent.

However, the claim is not to be found on ConvergEx’s website, which is full of heavy-duty stuff about the “mission-critical proprietary software products and technology-enabled services” that the company provides to more than 4,000 customers in over 100 markets. So I e-mailed the press officer, who responded by asking what I proposed to do with the note. I told her I thought I might write about it. She didn’t reply and didn’t send me the note either, so I was relying on the Waikato Times.

But last week Mr Colas turned up on CNBC and repeated the claim, even suggesting a common factor that might cause it. Nations that are lax in tax collection might be more likely to have low tobacco taxes, and also to run up large public debts, he said.

Actually it’s far more likely to be one of those odd correlations which signify nothing. As Thomas Lumley pointed out on Stats Chat, smoking rose and is now falling, while debt-to-GDP ratios have followed a more exciting trajectory.

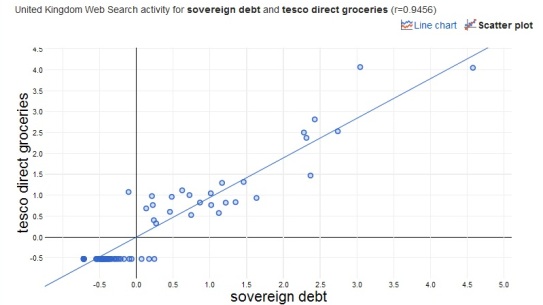

You can generate dozens of correlations using Google Correllate, a online tool that matches searches for different subjects. For the term “sovereign debt”, using only UK searches, one of the best correlations is with “Tesco Direct Groceries”. Here’s the scatter plot (r = 0.9456).

Does this mean anything? Why should searches for sovereign debt be correlated so well with those for online groceries? No reason except coincidence. The same applies to ConvergEx’s cigarette butt index.