Getting in a spin over public sector pensions

Public sector pensions are complicated enough without journalists trying to use statistics to stir things up even more

The Sunday Times reported (July 3) that, for the first time, there are now more civil servants on pensions than there are working. The Daily Telegraph followed the story up the next day, both stories asserting that there are now 17,000 more people drawing civil service pensions than there are currently employed as civil servants.

This is just the sort of story to delight readers of these two papers, who probably don’t include many civil servants. But is it true, and does it matter?

The Telegraph’s standfirst makes the article’s position pretty clear: “Retired civil servants drawing gold-plated taxpayer funded pensions now outnumber those employed in the civil service for the first time.” That scores pretty high on the shock ratings. Not only are crusty old civil servants “drawing gold-plated” pensions but even worse, they’re “tax-payer funded and there’re less of them working than claiming.

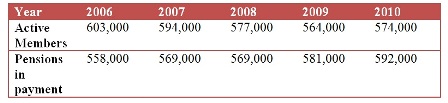

We’re not told by The Telegraph where the ‘official figures’ are from, but The Sunday Times cites government accounts. By this it means the annual accounts of the principal Civil Service pension schemes, published annually. For the past five years these show declining numbers of active members and rising numbers of pensioners. If you exclude those with deferred pensions, but include the pensions paid to the dependents of pensioners who have died, the two lines crossed in 2009 (see table).

So it is not the first time this has happened – it actually happened in 2009. The reason the numbers converged is as much due to reducing numbers of active members as to an army of grasping pensioners – the active list has declined by 29,000 since 2006, while those in receipt of pensions has increased by 34,000. Of the 592,000 drawing pensions in 2010, 129,000 were widows or widowers of civil servants – a group who can hardly be described as receiving “gold-plated” pensions.

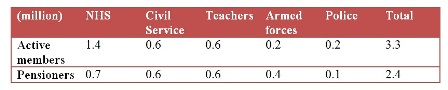

If either paper really wanted an example where pensioners outnumber active members, they should have looked at the armed forces. Data from a House of Commons Library Note (SN 05768) brings together data from the five largest pay-as-you-go schemes (Table 2). Again excluding deferred members, the table looks like this:

This shows that these five schemes had a total of 3.3 million active members, and 2.4 million pensioners. But armed forces pensions in payment were twice the numbers of those still on active service and contributing. However, nobody wants to be rude to soldiers, sailors and airmen. It’s more fun to characterise civil servants as fat cats.

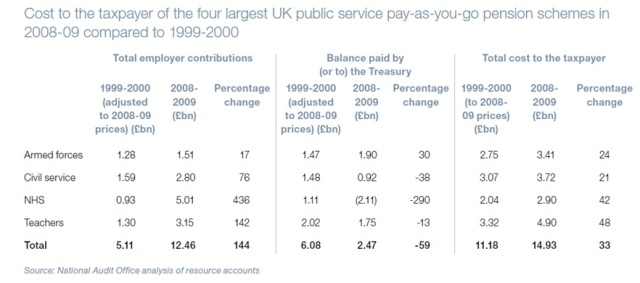

What matters ultimately is not whether there are more people working than receiving pensions, but what the liabilities are. A report by the Comptroller and Auditor General in March 2010 summarised the figures for the four principal schemes

This shows that the cost to the taxpayer of these schemes did increase between 1999-2000 and 2008-09, but not quite so dramatically as sometimes assumed. More of the burden was passed by the Treasury to the employing departments: the total cost to the taxpayer rose by 33 per cent. The rise in the civil service cost was the lowest of the four.

.

Richard Johnson (not verified) wrote,

Mon, 11/07/2011 - 21:01

I pay a decent chunk of my monthly salary into a local government pension scheme. It's well funded and doesn't face any problems. Weirdly the press keep referring to it as "gold plated".

I've checked the pension statements to see if I will get paid in gold plate, but it seems not. Modest amounts of money are what I'll get paid, many years hence, not gold plate. So what are the press wittering on about?

Richard (not verified) wrote,

Tue, 12/07/2011 - 16:59

The press has an agenda to kick public servants and will selectively use or even skew statistics to justify itself.

In the upcoming enquiry into press practices announced by the prime minister, I do hope factual accuracy is given the weight and prominence it deserves and that fact-checkers like Straight Statistics lobby for this to happen. Even though accuracy of reporting is the first rule in the current code of practice for journalists, it is brazenly flouted on a daily basis and in my experience it is nigh impossible to get the Press Complaints Commission to oblige papers and broadcasters to correct their 'mistakes' - and on the rare occassion when they do comply, they without fail break another rule by not giving the correction the same prominence as the original 'mistake'.

Will Straight Statistics be pushing for this?