Iffy maths from the TUC on pensions

The TUC, apparently reluctant to believe George Osborne’s promise to pensioners in his Budget, issued a press release on Saturday claiming that the old would have been better off over the next three years if he hadn’t changed anything at all.

But the maths was wrong and the conclusion, in my view, misleading.

In the Budget, George Osborne made a change in the method for indexing benefits which over a long time makes a big difference. In future, he said, benefits will be updated in line with the Consumer Prices Index (CPI) rather than the Retail Price Index (RPI).

The RPI includes housing costs and Council Tax, and tends to be higher than the CPI. So that means in most years the increases will be smaller. Osborne acknowledged this, saying the shift would bring benefits indexation into line with the preferred measure of inflation, and that it would save £6 billion a year by the end of this parliament.

Nigel Stanley, who blogs on the TUC’s Touchstone site, pointed out that over a long period this apparently small change will make a big difference. But Osborne did not deny this: he presented the change as part of his programme of public sector cuts.

For the old age pension, however, he came up with a different system. Bowing to long-term pressure from trade unions and pensioners, he promised that in future the state pension would be linked to earnings. In fact, he made a complex promise, the so-called “triple lock”: pensions would rise by the same level as earnings, CPI, or 2.5 per cent, whichever is the greater.

The TUC’s press release claimed that the changes meant that pensions would as a result rise more slowly over the next three years than they would have done under the old system. Sly Osborne had pulled a fast one, they implied.

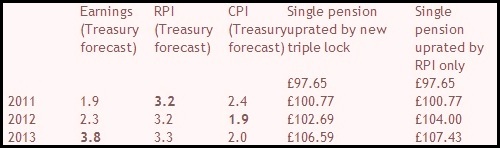

In fact, the table from the TUC’s press release (below) did not apply the triple lock correctly. It used Treasury predictions of earnings growth and CPI and RPI increases over the next three years to compare what will happen to pensions uprated by RPI, or the triple lock. The figure it quoted for 2012 (£102.69) is the uplift on 2011 based on a CPI increase of 1.9 per cent, not the 2.5 per cent the triple lock guarantees. The figure ought to be £103.29.

The following year, the increase in earnings is expected to be 3.8 per cent, so that will raise the pension to £107.22, compared with the £107.43 it would have been if it had remained linked to RPI. Less, certainly, but only 21 pence less, rather than the 84 pence projected by the TUC. Nigel Stanley has now blogged again with the right figures.

A minor mathematical error promptly corrected is no hanging offence, and the TUC was right that projecting forward for three years the uplift will be smaller than if the old system had remained in place, albeit only by 21p. But what if you look back to 2000, using real earnings and CPI figures rather than projections?

In four years out of the ten, the 2.5 per cent uplift would have been more generous than RPI, and in every year but 2005 and 2008 it would have been higher than CPI. Linking wages to RPI, as the TUC apparently wants, would have produced a 28 per cent increase since 2000, while Osborne’s triple lock could not have generated less than 31 per cent.

But in fact quibbling about differences between RPI and CPI is almost irrelevant over those ten years, because earnings grew much faster than either. In almost every year the increase would have been determined by the increase in earnings, not CPI or the 2.5 per cent guarantee. So pensioners would have been far better off than they are today. Earnings rose by 38 per cent between 2000 and 2009.

The coalition government has restored the link to earnings first severed by Margaret Thatcher in 1980, and which Labour frequently promised to restore, but never did. Tax experts suspect that by doing so Osborne may have taken on a greater commitment than he realises, and undone many of the cuts he made in other areas of public spending.

For this he gets criticised by the TUC, which has long campaigned for the change. Nigel Stanley’s original blog (but not press release derived from it) did acknowledge that that over time the triple lock will be more generous for pensioners. He said: “In the past earnings have outstripped prices over time (if not every year), and over a longer time frame the triple lock may well turn out better than a simple RPI link, but if we have a lost decade where the economy fails to grow much, who knows what will happen.”

In other blogs he has pointed out that the treatment of old-age pensions is different to that for other benefits or the second state pension, which will have no triple-lock. They will be uprated by CPI only, so that many pensioners with a SERPS pension (or an SP2 pension, as they are now called) will lose growth in those.

This has a knock-on effect for public sector pensions. Civil servants believed they were guaranteed pensions linked to RPI, only to be told that in future CPI will be the criterion. This is because public sector pensions are uprated in the same way as the state second pension, and that is now by CPI.

Was the Chancellor entitled to make this change? The Treasury says he was. I don’t know, but if I was paying into a public sector pension scheme, or receiving a public sector pension (no such luck, I’m afraid) I’d try pretty hard to find out. Over a long retirement, it’ll make a big difference.

R Booth (not verified) wrote,

Fri, 09/07/2010 - 09:18

the difference between serps or sp2 and public sector pension future increases to cpi is the public sector get 25% tax free on there pension but pensioner on retiring does not get 25%tax free on his serps can you please explain why. my serps pension has always increased in line with my basic pension until april this year; i have paid into my serps like my pension and think entitled to parity increases